If you are looking to avail the Prime Minister Youth Loan Scheme2023 , the best time to apply is through the online application form. The online application form is available on the website of the Ministry of Youth Affairs and Sports. If you are looking for a quick and easy way to apply for a government-sponsored loan, then look no further! The Prime Minister Youth Loan Online Application Form is an online application system that will help you get the money you need as quickly and easily as possible on study.com.pk. The form to apply for a Prime Minister Youth Loan is now online. This loan is meant for students who are in their final year of higher education or who have finished their apprenticeship. The maximum amount that you can borrow is Rs10,00,000.

Prime Minister Youth Loan Scheme 2024 Online Application Form

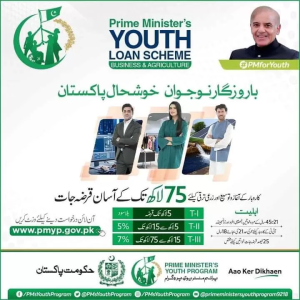

The State Bank released a loan acquisition under the “Primary Ministers Successful Young SME Landing Program” program for providing young people with free loans on easy terms for small businesses. According to State Bank, the application form for the loan can be obtained from the branches and websites of the National Bank, Bank of Punjab and the Bank of Khyber. PM Kamyab Jawan Loan Program 2024 Apply Online Eligibility Criteria Last Date. Banks have been instructed to enter their toll-free numbers on the application form so that their youth can guide their business.

PM Kamyab Jawan Loan Program 2024

Fill out the online application form and provide all the required information, including your personal details, business idea, and financial information. Submit the completed application form along with any supporting documents that are required, such as proof of identity, proof of residence, and financial statements. Once your application is received, it will be reviewed by the relevant authorities and you will be informed of their decision within a few weeks. If your application is approved, you will receive the loan according to the terms and conditions of the program.

Kamyab Jawan Loan Program 2024 Apply Online

The application forms will be started immediately after the Prime Minister’s inaugural ceremony of the program. Under this program, youth can get loans from one million to 50 lakhs for their business on which the interest government will pay and the burden on levying losses will also raise the government itself. Men and women aged 21 to 45, who are a computerized identification card, can take a loan to start their business under this program. The age range for IT and Ecommerce has been given a special discount and can use this scheme for the age of 18 years of age e-commerce or IT business.

pmybl online Apply

To apply for a loan through the www.pmyp.gov.pk Loan Scheme 2024, you will first need to register with the PMYLC using your National ID card or passport number. Next, you will need to complete an application form and provide documentation supporting your application. You can also submit additional documents if required. Once your application has been processed, you will receive an approval letter specifying the amount of your loan and the terms of repayment. You will then need to sign the loan agreement and submit copies of all relevant documentation to the PMYLC.

www.pmyp.gov.pk Online Apply

This program divided in two categories in first 1 lakh to 5 lakhs and second position is 5 lakh to 50 lakhs. These will be given in the form of debt working cotton and terminals, which are 8 years in which one year can be added. For the first-class business, youths will have to invest 10% from their own, while youth for the second-class business will have to pay 20 percent.

PM Kamyab Jawan Loan Program 2024 Apply Online Eligibility Criteria Last Date

Online Application Form Download: Click Here

How to Get PM Youth Business Loan 2024

The Prime Minister’s Youth Business Loan Scheme is a program designed to provide financial assistance to young entrepreneurs in Pakistan who want to start or expand their business. To apply for this loan, you will need to meet the following eligibility requirements:

- You must be between the ages of 21 and 45.

- You must be a Pakistani citizen.

- You must have a valid National Identity Card (NIC).

- You must have a business idea that has the potential to generate employment and contribute to the country’s economy.

- If you meet these eligibility requirements, you can apply for the loan by following these steps:

- Visit the website of the Prime Minister’s Youth Business Loan Scheme.

- Click on the “Apply Now” button on the homepage.

How to get UBL Prime Minister’s Youth Business Loans

To apply for a UBL Prime Minister’s Youth Business Loan, you will need to follow these steps:

- Visit the website of the United Bank Limited (UBL) in Pakistan and navigate to the section on the Prime Minister’s Youth Business Loan Scheme.

- Review the eligibility requirements for the loan. To be eligible, you must be between the ages of 21 and 45 and have a valid National Identity Card (NIC). You must also have a business idea that has the potential to generate employment and contribute to the country’s economy.

- If you meet the eligibility requirements, click on the “Apply Now” button to access the online application form.

- Fill out the application form and provide all the required information, including your personal details, business idea, and financial information.

- Submit the completed application form along with any supporting documents that are required, such as proof of identity, proof of residence, and financial statements.

kamyab jawan program.gov.pk online

Once your application is received, it will be reviewed by the relevant authorities and you will be informed of their decision within a few weeks. If your application is approved, you will receive the loan according to the terms and conditions of the program. It is important to note that the UBL Prime Minister’s Youth Business Loan Scheme is only available to entrepreneurs in Pakistan.

|

Salient Features |

| Brief Description | Small business Loans will focus on (but will not be restricted to unemployed youth, especially educated youth looking for establishing or extending business enterprises. |

| Eligibility criteria | All Men/Women holding CNIC, aged between 21 and 45 years with entrepreneurial potential to apply from designated branches mapped with area of residence/business. |

| Security Requirements | One Guarantor |

| Permissible Collaterals | Business hypothecation |

| Focus on women | 50% of loans will go to women borrowers. |

| Debt-Equity ratio | 90:10 The borrowers’ contribution of equity would be in the form of cash or immovable property and will be required after approval of the loan. |

| Loan Period | The maximum tenor of the loan is 8 years, including one year’s grace period |

| Pricing | 8% fixed for borrower. Government will pay the difference of the cost of KIBOR + 500 bps. |

| Number of loans | 100,000 |

| Size of Loan | Upto Rs 2,000,000 (Twenty Lacs) |

| Allocation in budget 2013-14 | Rs. 5 Billion |

| Executing agency | In the first instance, National Bank of Pakistan (NBP) and First Women Bank Limited (FWBL) under the guidance and supervision of State Bank of Pakistan( SBP) to ensure participation of private banks:

a) Private banks will be required to participate in this scheme on the basis of soundness of business proposals; and b) SBP will encourage private banks to build this portfolio commensurate with their size. c) SBP will arrange appropriate training for private banks to implement this scheme. d) NBP will continue to play the lead role |

| Sectors and Products | All sectors. Standardized schemes /projects/undertakings will be designed by SMEDA, projects designed by private sector service providers or individuals themselves will also be admissible.

Role of SMEDA: a) The 50 feasibilities prepared and uploaded by SMEDA will b extensively publicized and their access to public made easier through multiple linkages with other relevant websites. b) SMEDA will work closely with Punjab Information Technology Board (PITB) to ensure that the schemes are accessible to those who participate in PITB survey. |

| Application Form | The Form would be both in English and Urdu, and required minimum essential information with simple format.

The processing time will not exceed 15 days and will be so stated clearly in the application form; and The form would be readily available both in branches and through dedicated websites of the banks. Non – refundable form processing fee will be Rs. 100 (One Hundred) |

| Monitoring | SBP will publish consolidated information about the loans extended under the scheme for information of the public on quarterly bases on its website;

An effective Complaints Center to process and resolve complaints will be set up; E-government directorate of Ministry of IT will provide support |

| Geographical Distribution | Whole of Pakistan. In case of Baluchistan, at least one branch of NBP will be designated per Division.

All non-designated branches will also provide and receive filled application forms and dispatch them to the nearest branches. |

All the information Kamyad Jawan Loan Program mention here. If you want to get any other information related this post then use the comment option.

i want loan please.

i want to get loan please tell last date.

Post mn last date mention ki gai ha sir

Not ans

Sir what to want please tell us

Hi

Hello

Prime manastar lone scam

Aplay wazir Azam jawn kamiyab program lone

Ubl

Sir I Have applied in 2019

Ap ne call k hamara nimaida ap k pass. Aega mager ap na nimainda nahen a ya sir mere case ka KIA huwa please tell me

I want to get loan please tell me date

How can me Get Loan . how can me apply online

I want to get loan please

[email protected]

kamyab jawan program add me

kamyab jawan program

Ilove Pakistani

Kamyab Jawan program add me please

Kamyab program ma add me

kamyab jawan program add me plzzz

Mujhay karobar ka liye loan chaye

Mujhe apni Zameen kliy Soler pump lagwna hi es Liye mujhe loan ki ashad zarorat hi

I neend your help

PLZ CONTACT NUMER 03200015608.I WANT SMALL LOAN

Apply kese kren